Perhaps the most aggravating thing for me personally these past few years has been City Hall’s lack of regulation on spending. Many of the incumbent candidates want us to believe their fiscal records are exemplary because they’ve ‘cut and balanced the budget.’ However, what most people should hopefully already know, balancing a budget and reducing spending are two entirely different things. Let’s try a really simple analogy to help our civic leaders understand how things work in most people’s businesses and homes.

Let’s say I really like to eat apples. I’ve worked hard and saved up enough to purchase 5 apples. Now I can use those apples however I like; I can make apple sauce, maybe a pie, or just eat them raw. If I only need 5 apples, then my budget has aligned with my reality and I have been fiscally responsible. Yay me!

Now, let’s say I still need 5 apples, but on top of that, my kids need an extra 10 apples for school. Now I have a budget expense of 15 apples. What do I do? I might work really hard and save for those extra apples, but maybe I just don’t reach that goal. Sorry kids, there won’t be any apples for you.

But what if I had a magical, unending pot of money? For lack of a better term, let’s call it…um… “taxes.” Let’s say that I can just reach into that pot of money and pull out whatever I need to buy as many apples as I want. Now I can buy all 15 apples that my family needs, but maybe I’ll buy another 15 apples because I also want to have more apples. Time to dip into the “taxes” so that I can have all the apples! But you know, now that I have the “taxes” to support my budget of 30 apples, it still isn’t fiscally responsible for me to buy all 30 apples. I need to demonstrate to my friends and family that I can be prudent with “taxes”, so instead I’ll “cut the apple budget”. Now I’ve only budgeted for 20 apples. That’s better. Now I can point to my savvy budget control measures as demonstration of my effective leadership on the apple cart.

“But wait!” you say. “Don’t you realize that you can only truly afford 5 apples? You can’t afford to purchase another 15 apples! The fact you cut your budget from 30 to 20 is irrelevant! You’re still spending more than you can afford!”

This certainly seems like a pretty common-sense measure, so why is it such a challenging concept for our City?

Just like apples, another seemingly simple measure that has failed in recent years is; bridge building.

It is unfortunate to see how far the relationship between one of the largest taxpayers and the City has deteriorated so much in the past couple of years. Our Councillors and Mayor are elected to represent taxpayers and serve their interests, and so it is disappointing to hear those same leaders say the responsibility is at Revelstoke Mountain Resort’s doorstep to reach out to City Hall in order to mend fences. That just sounds like pure blatant stubbornness from someone who knows they are in the wrong, but perhaps too arrogant to admit it.

Has the resort development changed Revelstoke? Certainly. Has it been for the better? Certainly. Once again, numbers don’t lie. Since the development of the resort:

- The Hospitality and Tourism sector has grown from 9% to 17% of the local economy.

- Between hotel development, guiding services and construction, this has led to approximately 200 new full time/year round jobs.

- Those jobs generate close to $3,000,000 in wages that are circulated within the community.

- The development of the ski resort jump-started our business community. Business licenses have increased increase over 30% from 2005.

- Resort infrastructure, including subdivisions, were all 100% funded by the resort without the use of any municipal tax dollars.

- Much of the resort infrastructure sits on Crown land, does not receive any City services, yet is still subject to municipal tax rates.

- The only property not owned by the City to fall under Class 8 tax classification is RMR. The mill rate on this property class has risen 71.5% in the last 6 years.

- The approximate total of taxes paid by RMR in 2013 was $1.4 million. Remarkably this does not include taxes paid by strata homeowners, which are taxed separately.

Some would have us believe that the resort is to blame for increased spending and a drain on our local services, but as you can see from information acquired from RMR and City Hall, this is not the case. For the most part, RMR is not serviced by the City, and yet is taxed to near-tyrannical levels. Are we really to believe that a few thousand extra visitors flushing toilets in our town necessitate a massive increase in City spending, from $9.5 million in 2006 to $19.9 million in 2013? Give your heads a shake if you believe that one.

It is time for our leaders to extend the olive branch, to practice gratitude instead of contempt, and work diligently to support this vital Revelstoke industry. It is the job they are elected and paid to do after all.

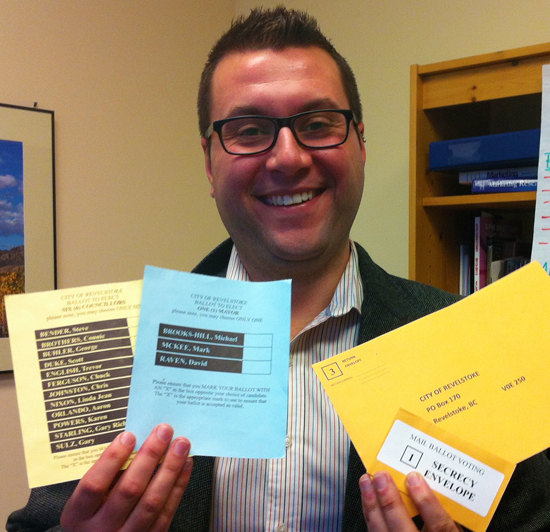

Whoever is elected on Saturday will need to right the apple cart and pull it across some new bridges in order for Revelstoke to move forward out of the mud. Please remember to get out and vote on November 15!

Voting feels good. It’s what all the cool people are doing this year.