By David F. Rooney

It’s been 60 years since the Revelstoke Credit Union was founded and, my, has it changed over the years.

It was started in 1953 in Erma Todd’s wood-framed house on Sixth Street and had 18 charter members and assets of $35. Its first loan was for $100. It even occupied space at Rutherford’s Garage — that’s where The Cabin is today — before it purchased a site at First Street West and Connaught in 1961 and in 1964 bought the property it now occupies. Then it was a single-storey building. Today, its two-storey concrete, stone, glass and cedar building dominates the corner of Second Street and Connaught Avenue. It has over 5,000 members and assets in excess of $163.3 million. Last year, it returned $168,608 to those members.

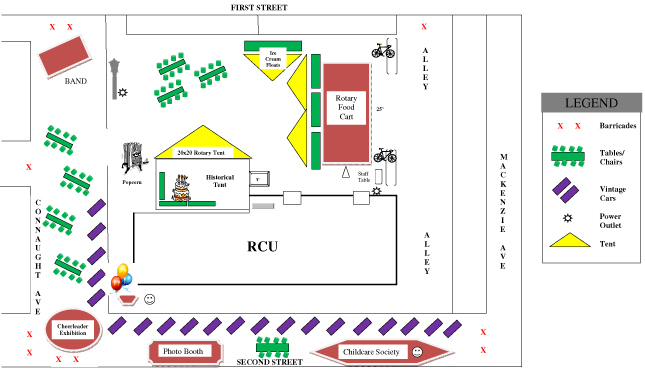

Now it’s giving something else to its members — an, afternoon-long party like no other on Saturday, September 21, with free food and refreshments, children’s face painting, cheer leading exhibition, live music, vintage cars, photo booth, historical memorabilia, and lots of prizes. It’s open to everyone in town and it’s all free. (Please click here to see a larger version in PDF format of the map below.)

And why not throw a party? The past 60 years have been good ones for the Revelstoke Credit Union.

Its health and wealth are clearly linked to the overall health of our local economy, which is good news when you’re a relatively small financial institution with deep local roots. Perhaps, more importantly its corporate culture ensures that it is loyal to its members and the overall community. And they, in turn, are loyal to it.

CEO

Revelstoke Credit Union

This is a dynamic relationship that pleases its CEO, Roberta Bobicki.

Roberta has been with the Revelstoke Credit Union for 32 years, having started out with it in 1981 as a humble teller earning $1,000 a month.

Those were different times.

Back then the RCU had just 15 employees. Today its staff “is just shy of 50” and the entry-level salary is about $26,000.

“I remember when I started we used to have a table behind the teller line,” she said in an interview. “We’d sit there smoking and doing chequing account statements.”

There was a smaller customer base and Credit Union staff would go into the schools to encourage children to save their money.

Over the years, Roberta worked her way up the credit union ladder, working in most departments of the institution. By 2007 she was the natural choice to take the helm when Jay Strong resigned as CEO.

“Jay Strong really grew our commercial base,” she said. “It was a gap that we had and he filled it successfully.”

Talking with a banker it would be easy — and natural — to talk about money and profit and loss. And while those things are important to Roberta she has some other priorities.

One is meeting the challenge posed by a generation of people who want to use different avenues of communication with their financial institutions. There’s online banking and now you can even use your smart phone to do your banking and even your purchasing. That’s a significant challenge.

You have to be over 50 to remember when ATMs and debit cards were introduced in Canada back in the mid 1970s. Those innovations changed the face of banking, especially at the big chartered banks. They began cutting their front-line staff as the cards and machines because ever-more popular. Well, the new technologies and software are certain to have an impact on banking, too.

Talking with Roberta about the credit union you can’t help sensing that she enjoys challenges but while that may well be true, what matters most to her are the people she works for and with — member, the board and credit unions staff.

“The parts that really matter to me are the people who work here,” she said.

RCU is small enough that there is a feeling of solidarity and approachability within its structure. Management hasn’t been divorced from staff as sometimes happens when organizations expand. And naturally because this is a small city, credit union staff get know all of their customers on a first-name basis.

Another thing the credit union is proud of is its culture of encouraging excellence and education within its ranks.

“Staff education is a real priority,” Roberta said. “We now have a CGA, a CHRP, a CFP, an AMP, 2 FCUICs, 3 CAIBs, 3 Life Agents, 2 BBAs, a CNE, an MCSE, a BA JUS, an AD ART, a HADM and more. What these designations and degrees mean is that our members’ needs are handled by a very-well-educated staff.”

Providing “human growth and opportunity” is as much a part of the credit union’s corporate culture as its dedication to helping out Revelstoke’s many non-profit organizations and clubs with thousands of dollars in grants and awards.

The same holds true for RCU’s volunteer board of directors.

Times have changed in terms of what directors are expected to know. Gone are the days when almost any reputable and intelligent person could be asked to sit as a director. Oh, you still have to be smart and have a reputation for honesty and integrity. But now, in the wake of the economic meltdown in 2008, the regulatory demands on credit union boards have changed.

“We’ve always been lucky to attract highly qualified directors to our board,” Roberta said. “Back in the day every loan had to be approved by the board of directors. That’s changed. Today it would have to be an extraordinary loan — over a million.”

The regulations that govern financial institutions in Canada also now demand that directors receive training so that they can ensure that the credit union is healthy and in compliance.

But, ultimately, while the Revelstoke Credit Union exists to take of care of its members’ financial needs what matters most is its relationships with the ordinary men, women and organizations that use it.

“I hope that I have had a positive influence on members’ lives over the years by helping them get a new home or working to help them out of a mess,” Roberta said, adding that her proudest moment is the day “we donated over $80,000 to pay the balance due to get the new Rescue vehicle.”

Happy birthday to the Revelstoke Credit Union and its staff. We wouldn’t be the community we are today without you.

If you like numbers please click here to read the Revelstoke Credit Union’s 2012 Annual Report.