By David F. Rooney

Premier Christy Clark “is not optimistic” about BC’s prospects for avoiding another Softwood Lumber War with the United States.

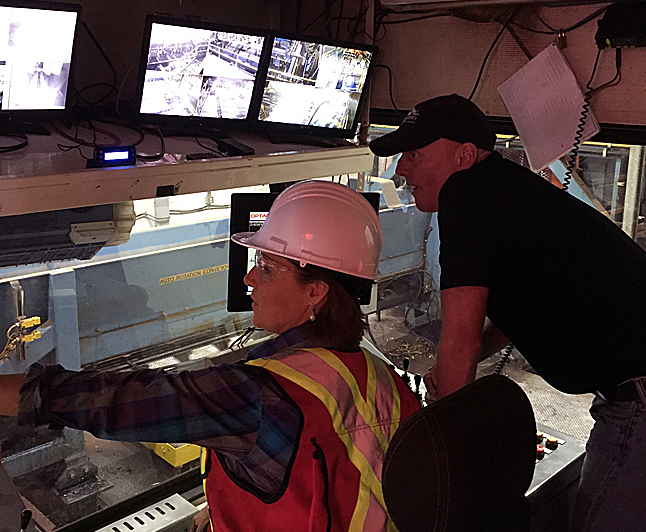

“I’m not optimistic but I am hopeful — I’m always hopeful! — and we’re working our tails off to get an agreement but the Americans do not seem motivated to get one,” she said in an interview after touring Revelstoke’s Downie Timber Mill on July 13.

“We are not interested in just any deal. We are not interested in a deal that involves a quota, for example,” Christy said. “If the Americans say we have to have a quota system in Canada we’re not taking it. It will be bad for this mill (and others like it across the province) and we won’t take it.”

BC has “a basic bottom line: No quota; it has to be fair to Canada; and the ultimate deal has to be driven by the interests of British Columbia because we produce 50 per cent of the softwood we export.”

The Softwood Lumber War is one of the largest and most enduring trade disputes between both nations. This conflict arose in the early 1980s and its effects are still seen today. As Canada’s largest lumber exporter to the US, BC was most affected, reporting losses of 9,494 direct and indirect jobs between 2004 and 2009.

At the heart of the dispute was the claim that the Canadian lumber industry was unfairly subsidized by federal and provincial governments, as most timber here is owned by the provinces. The prices charged to harvest the timber (the so-called stumpage fee) are set administratively, rather than through the marketplace. The US lumber coalition claimed this constituted an unfair subsidy and was thus subject to their country’s trade-remedy laws, where foreign goods benefiting from subsidies can be subject to a countervailing duty tariff, to offset the subsidy and bring the price of the commodity back up to market rates.

The Canadian government and lumber industry disputed this saying Canadian timber is provided to such a wide range of industries, and that lack of specificity makes it ineligible to be considered a subsidy under American law. Under US trade-remedy law, a countervailing subsidy must be specific to a particular industry. This requirement precludes imposition of countervailing duties on government programs, such as roads, that are meant to benefit a broad array of interests. Since 1982, there have been four major iterations of the trade war and, without a new agreement, there will almost certainly be a fifth round.

Downie laid-off many workers at the height if the last battle, but it also kept running with — at times — just a single shift a day and its owners, the Gorman Brothers, invested $20 million in new automation.

The 2006 Softwood Lumber Agreement expired in October 2015. (Click here for more about Canada position.)

The US Lumber Coalition is pretty much saying the same kind of things it claimed in the last go-round:

“Since the Softwood Lumber Agreement with Canada expired in October 2015, the U.S. Lumber Coalition has been working hard to support negotiations between the two nations aimed at designing an effective framework for offsetting trade distortions and job losses in the US market caused by unfairly priced Canadian imports.

“As part of the 2006 trade agreement, the U.S. industry agreed that it would not file new petitions for relief from subsidized or low-priced imports for one year after the agreement’s expiration. That one-year ‘standstill’ period ends on October 13, 2016. If no new agreement with Canada has been reached by that date, the Coalition will evaluate whether the time is right to file new petitions against imports of softwood lumber from Canada that are subsidized, dumped, or both.”

Peter Clark, one of our country’s leading international trade strategists, said in an article published in May that “the prospect of a Donald Trump presidency adds urgency to an expedited negotiation. Hillary Clinton, who is being pushed to the left on trade by Sen. Bernie Sanders’ success in the primaries, has promised to appoint a special prosecutor to defend U.S. trade interests.

“No matter who is the next president, the incoming administration will have to show it will be tougher on enforcement. And it will be completely disorganized and unfocussed for months into 2017. The U.S. Lumber Coalition will have an unimpeded run down the field until the countervailing duties rates… are announced, and maybe thereafter. The pressure to negotiate and compromise is entirely on Canada. The Coalition benefits from any delays.”

No matter the outcome of Americans’ presidential election this fall, Canada is going to take a hit when it comes to trade, Clark said.

When it comes to trade between the two countries Donald Trump and Hillary Clinton look set to “become the most protectionist president in American history,” Clark said. “It’s hard to distinguish one from the other because both of them at the moment look like they’re pretty anti-trade and therefore pretty anti-Canada.”