By David F. Rooney

For the first time ever, Revelstoke City Council is working on a budget months before they are required by law to do so. So is this budget any different from previous ones?

In some ways, yes or perhaps maybe; in others, no it’s not so very different. Using the results of this autumn’s public survey as justification, the current draft of the budget — and it is only a draft at this point — calls for a 3.9 per cent tax increase.

“This is the earliest we have every drawn up a financial plan,” Mayor David Raven told the crowd of 18 people who jammed into the public seating in the Council Chamber on Thursday afternoon.

Past budgets have never been introduced until January of each year and generally are not completed and approved until just before they are required by law to do so in May of each year.

Raven told Council and the audience that he wants the budget submitted to the public for comment on December 10. There will also be a Town Hall-style public meeting on the budget to be held on January 14. The location and details of that meeting have not yet been announced.

“I’m looking forward to a healthy and respectful debate,” he said, emphasizing the words “healthy and respectful.”

Over the last four or five years Mayor Raven and Councillors Steve Bender, Chris Johnston, Linda Nixon, Tony Scarcella, Gary Starling and Phil Welock have been privately criticized, denounced and vilified by members of the public angered by what they regard as escalated spending.

The financial plan, presented by Finance Director Graham Inglis, says:

“The rapid growth of the community with the RMR development creates challenges for balancing City revenues, costs and investments.

“City operating revenues are sourced from property taxes, and fees for various services, the grant‐in‐ lieu of taxes from BC Hydro for the Revelstoke dam, cost sharing arrangements for particular services with the Columba Shuswap Regional District (e.g. fire protection) and provincial transfers. Other cost sharing arrangements with the Columbia Shuswap Regional District include or may include the airport, cemetery, or parks and recreation.

“Projected operating costs currently exceed these revenues, prompting the need for careful consideration of service levels to avoid unacceptable tax increases.

“Substantial capital investments are necessary for roads, buildings, equipment, water, and sewer enhancements to meet the needs of the growing community. These investments are funded through general revenues, reserves, borrowing, development cost charges, grants, and, for tourism infrastructure, resort municipality hotel tax revenues. “While development cost charges are designed to fund infrastructure for new development over the long term, in the short term the City may have to finance community infrastructure improvements, often without certainty about when developments, and development cost charges will be realized.”

The budget anticipates revenues of $22.75 million and total expenses of $21.1 million in 2014. The relevant numbers for 2015 are $23.17 million and $21.06 million, respectively. For 2016 they are $24.03 million and $2.11 million; $24.63 million and $21.27 million in 2017; and $25.24 million and $21.38 million in 2018.

Even so, the plan says “Council has set a number of objectives for 2014, some of which will have a direct impact on the financial plan. The most notable of these are:

- The inclusion of $125,000 over 2 years, commencing 2014, for further departmental reviews.

- The addition of one additional police officer in 2013 did not proceed and has now been eliminated from the budget.

- Targeted cuts in hours to save employment costs. Some service levels will be affected.

A $90,000 deficit is projected for 2014 but there should be a consolidated accumulated surplus of $1.03 million thanks to surpluses in general operations, water and sewerage. Accumulated surpluses of $1.15 million, $1.18, $1.65 and $2.39 million are predicted for 2015 – 2018.

Raven told the audience that the survey — the full results of which will not be released to the public until December 10 — shows that residents want current service levels maintained.

However, that is difficult to achieve. Spending on everything from the City’s fleet of vehicles to roadwork and improvements in sewage treatment is not going down.

There might be some assistance forthcoming from the federal and provincial governments but no one is counting on that.

“…both federal and provincial government revenues fell in 2009,” the plan notes. “Municipal government expenditures have been increasing at a faster rate than their revenues over the past 20 years. It is important to appreciate that the city is subject to a variety of different cost pressures:

- Inflation;

- Demands for new or improved services;

- Development growth; (and)

- Downloading from senior governments.

And that’s where the proposed tax increase comes into play. However, that 3.9 % increase is not yet carved in stone.

Councillor Gary Starling asked Inglis what it would take to prevent a tax increase.

Council would have to cut $200,000 in spending from the budget, he replied.

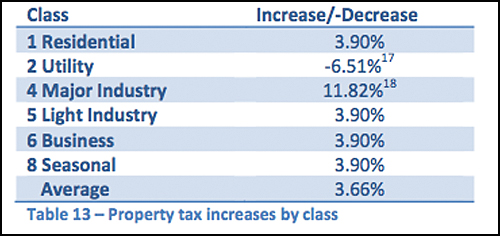

And when you look at back at the past three years that this Council has been in office “property tax increases have,” according to the plan, “averaged approximately 2.25% a year over the last three years. Business (Class 6) has averaged a 1.5% annual increase while residential (Class 1) has averaged 3.33%.

It’s not all doom and gloom.

This budget does project:

- A lower debt-to-assets ratio;

- No new long-term general debt after 2014;

- No new long-term water debt;

- No long-term sewer debt until 2017;

- The City’s long-term debt is shrinking, overall;

- Reserves and assets are increasing over time;

- Operating expense are increasing but only within a range of 1-to-2 % each year; and

- Expenses, including non-TCAs are being reduced in real terms.

The mayor wants a respectful and healthy debate and so does the Chamber of Commerce.

“We would really like to hear what the public has to say about this,” Judy Goodman, the Chamber’s executive director said after the special Council meeting.

Please click here to read the full draft Financial Plan 2014-2018.

Please click here to read City Council’s unprecedented Budget Preparation Directives to staff.