By David F. Rooney

City Council appears split over tax increases and whether it should begin looking for ways to cut services in order to rein in its growing debt and bolster its anemic capital reserves.

It’s also in dire need of some clear direction from the public. The relevant questions there are:

Do taxpayers really care about the budget?

And, should they care about it?

When Council met last week to discuss a draft budget to be presented to taxpayers for public discussion and input Councillors were clearly split over the wisdom of pitching an across-the-board 5% increase. Only 3% of that increase was identified as an actual tax increase. The remaining 2.5% was intended to help boost the City’s appallingly low reserves.

That increase was too much and it was time to begin looking at real service cuts argued Councillors Tony Scarcella and Chris Johnston both of whom thought the budget was not sustainable. Linda Nixon moved that the tax increase be reduced to 3.5%. Tony has been beating the cut-taxes and cut-services drum for a long time now — usually as a lone dissenting voice on Council. So it was interesting to see Johnston and Nixon agreeing — and voting — with him.

“I’ve been hearing this same litany for the last 10 years: ‘Oh! It’s only two per cent. Oh, it’s only two per cent. Oh, it’s only two per cent,’” Johnston said. “And now if we pass this it’ll be ‘Hey, it’s only 5 per cent.’”

Even Councillor Steve Bender, chairman of Council’s Finance Committee, thought it was too rich an increase.

Nixon’s compromise motion to reduce the tax increase to 3.5% in 2013, with 2% increases every year thereafter until 2017, was narrowly approved. Scarcella, Johnston and Nixon voted against it largely because they thought some kind of service reductions were called for. Councillors Phil Welock — who was concerned that cuts might affect planned infrastructure, Fire Rescue and RCMP programs — and Steve Bender voted for it. Councillor Gary Starling was not present for the Special Meeting, held at noon on February 19. However, Mayor Dave Raven voted with Welock and Bender. The Mayor’s vote is considered a tie-breaker.

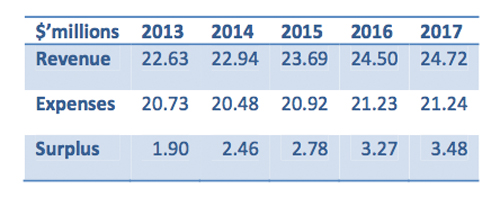

The compromise document, which was not released until last Thursday, offers taxpayers a residential tax increase of 3.5%, a percentage of which will applied to the City’s Capital Reserves. Business, light industry, and seasonal property taxes are set to rise by 3.5%, while utility rates will go by 7.07% and the heavy industry will increase by 3.95%.

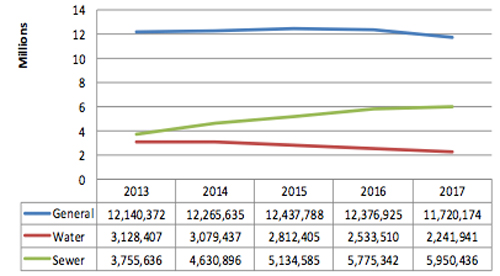

The City also needs to do something about its debt load, which currently amounts to about $19 million.

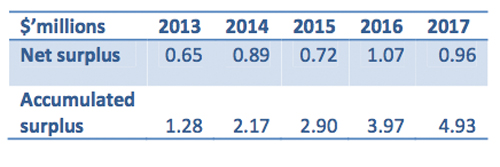

“If the city is to reduce its reliance on borrowing then it must ensure that sufficient funds are placed in reserve to meet the future cost of capital projects,” Finance Director Graham Inglis said in the executive summary to the 2013-2017 Financial Plan. “Grant funding from senior governments continues to become less prevalent and they have made it clear that they do not intend to fund the same asset twice. In other words, once the city has received grant funding to replace an asset its subsequent replacement will be entirely at our cost.

The financial plan also notes that:

“At the time of writing this report the global economic climate remains unsettled. Economic recovery is struggling against persistent debt issues in Europe and muted growth expectations in North America. The Bank of Canada has indicated that interest rates will eventually have to rise and that this might be sooner rather than later. However, Canadian inflation appears contained within the central bank’s target range so there would appear to be little argument for rates to increase any time soon.

“In spite of these headwinds, the ski hill operation continues to grow each year and the local business community appears not only to be weathering the storm but thriving.

“In 2011 (a study conducted by Chief Administrative Officer Tim Palmer concluded that) over 50% of Revelstoke’s business community thought that their business was doing good or excellent, compared with only 8.6% stating it was poor.”

That may well be, many in the business community are leery of being regarded as a cow waiting to be milked by Council. Some want to see the City reduce it’s spending, a view expressed by Budget Focus Group member Betty Sloan during the meeting. The Focus Group’s formal submission to Council will be presented during the month-long public consultation period that ends on March 28.

“I’m not comfortable with the tax increase and I’m not comfortable with this level of spending,” she told Council. “I think what we’re saying here is that there are bigger issues… It’s complicated. It’s not easy and there are very different points of view.”

Meanwhile, Mayor Raven said it’s all a matter of what the public wants. Does the tax-paying public want to see a reduction in services? How about infrastructure spending?

And therein lies part of the dilemma facing City Council: what does the public want?

Revelstokians have been so apathetic about municipal spending that the City received only five written submissions about City budgets in the last five years.

“Cutting services means less snow removal, less efficiency,” Raven said. “Last week we voted to create a new committee (dedicated to youth program development) that’s going to cost us money.

“When you send us your cards and letters please tell us what you don’t want.”

Raven’s plea for real public feedback is important and points to a trend that has been building for the last five or six years. Sure, it’s anecdotal but most people who have lived here for the last decade or so can recall a time when it was not unusual to get a turnout of 100 people or more for meetings on public issues. Today we’re lucky to get 60.

Perhaps the Chamber of Commerce will manage to ignite public interest in the budget when it holds an Open House on Tuesday March 12 from noon until 5 pm at the Visitors Centre on Victoria and Orton.

“This is an opportunity to review highlights of the proposed five year City Budget and to provide input into the Chamber’s submission to the City regarding the proposed property taxation increase,” Chamber President Steve Bailey said in a statement. “The Chamber Board of Directors and management have been approached by many local business owners and members of the Chamber to address the issue of the increasing burden of property taxes, specifically, to local small business.”

The public has until March 28 to review the budget and submit written comments to City Hall by Canada Post, hand delivery or e-mail.

They really do want to hear from you.

Click here to read the 2013-2017 Financial Plan.

Click here to visit the City’s website.