By David F. Rooney

Experts predict economic chaos to reign when the Royal Canadian Mint phases out the penny from Canada’s coinage…. Hey! Wait a minute — that’s not true. But it did get your attention didn’t it?

The actual story is a lot more prosaic. But it will have an impact on how we spend money.

In its Economic Action Plan 2012, the federal government announced it would phase out the penny from Canada’s coinage system starting on February 4.

The decision to eliminate the penny was due to its excessive and rising cost of production relative to face value, the increased accumulation of pennies by Canadians in their households, environmental considerations, and the significant handling costs the penny imposes on retailers, financial institutions and the economy in general.

For its part, the Revelstoke Chamber of Commerce is attempting to achieve a measure of consensus among local businesses as to when and if they want to stop accepting pennies at the same time. In an e-mail shotgunned out to the Chamber membership Executive Director Judy Goodman said:

According to the Mint, the estimated savings for taxpayers from phasing out the penny is $11 million a year. The cent will remain Canada’s smallest unit for pricing goods and services. This will have no impact on payments made by cheque or electronic transactions — only cash transactions will be affected. Moreover, pennies can still be used in cash transactions indefinitely with businesses that choose to accept them.

The Mint has helpfully issued some guidelines for the phase-out

Important Dates. To help consumers, businesses, charities and financial institutions to plan, a transition date of February 4, 2013, has been set after which the Royal Canadian Mint will no longer distribute pennies. On this date, businesses will be encouraged to begin rounding cash transactions.

Rounding Guidelines. As pennies exit circulation, cash payments or transactions only will need to be rounded, either up or down, to the nearest five-cent increment.

The government will be adopting a rounding guideline that has been used successfully by other countries for its cash transactions with the public.

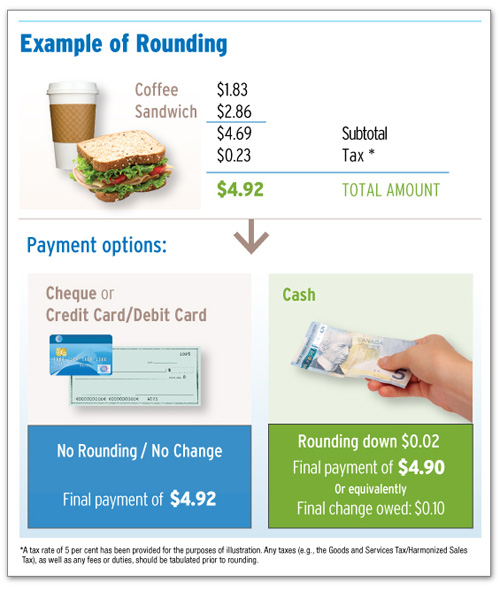

Under this guideline, when pennies are not available, cash transactions will be rounded in a fair and transparent manner, as illustrated below:

When to round. Again, only cash transactions require rounding. Cheques and transactions using electronic payments — debit, credit and payments cards — do not need to be rounded, because they can be settled electronically to the exact amount.

For any cash payment, only the final amount (or equivalently, the change owed) should be subject to rounding. Individual items, as well as any duties, fees or taxes, should be tabulated in their exact amount prior to rounding, as illustrated:

On a related note, the loonie is now 25 years old. Yes it has been a quarter of a century since Canadians said goodbye to one-dollar banknotes and welcomed the new coin in their pockets and change purses. At that time, it was the most significant change to Canada’s coinage system in over 50 years.

The one-dollar coin was introduced into circulation on June 30, 1987, as a cost-saving measure by the federal government. The coin was instantly dubbed the loonie, after the solitary loon that graces the coin’s reverse side. The nickname caught on and Canadians have been using it ever since.

Next stop — some day — a five-dollar coin?