By David F. Rooney

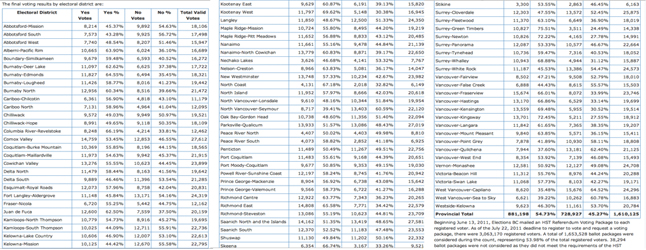

British Columbians overwhelmingly rejected the Harmonized Sales Tax during this summer’s referendum. The final vote, as revealed by Elections BC this morning, involved more than 1.6 million ballots. 54.7% of voters were against keeping the tax and 45.27% wanted it retained.

The final vote, provincially, was 881,198 who voted to extinguish the tax and 728,927 who wanted to keep it. In Columbia River-Revelstoke, 8,248 people or 66.19% voted to get rid of the tax while 33.81% or 4,214 valued it.

The results pleased MLA Norm Macdonald and people like Revelstokian James Walford who said he was “tickled pink” by the electorate’s rejection of the tax he campaigned against.

“Now we’ll see what happens next,” he said.

Macdonald, a vocal opponent of the tax during the campaign led by former premier Bill Vander Zalm and

“Ordinary people have stood up to a government that lost its way,” he said in an interview. “Now it’s time for Premier Christy Clark to get down to business… (and) outline a new financial plan.”

The New Democrat Forestry Critic said the results of the referendum, “especially here in the Kootenays shows people have a strong sense of what’s right and wrong. You can’t lie to people.”

That last comment was a clear reference to the BC Liberals’ claim before and during the last provincial election that they did not intend to alter the Provincial Sales Tax. As everyone knows they announced their intention to proceed with the Harmonized Sales Tax within weeks of winning the 2009 election.

Finance Minister Kevin Falcon said Friday that the province will reinstate the combined 12 per cent PST and GST tax system following the referendum decision by British Columbians to extinguish the HST.

In a statement on the BC government website he said an action plan has been established to “guide the transition process and help ensure an effective and orderly transition from the HST to the PST plus GST system in BC.”

“The PST will be reinstated at seven per cent with all permanent PST exemptions,” he said. “The province may make some common sense administrative improvements to streamline the PST.

“The transition period is expected to take a minimum of 18 months, consistent with the report of the independent panel on the HST. During this period, the provincial portion of the HST will remain in place at seven per cent. Eligible lower-income British Columbians will continue to receive the B.C. HST Credit until the PST is re-implemented. The B.C. HST credit will then be replaced by the re-implemented PST credit.

“During the transition period, the province will provide quarterly updates on the progress of returning to the PST.”